Greythorn Fortnightly Newsletter Issue #10

In-depth analytics and market insights for the fortnight by the Greythorn Research Team. Learn about the new Cosmos whitepaper and a dive into Chainlink after its recent rally.

Crypto Market Insights

Market Summary

Bitcoin & Ethereum are up 1.31% & 1.01%, respectively, over the past fortnight.

Binance lists $GMX.

The Binance Smart Chain halted on Thursday after an exploit on the BSC Token Hub protocol. An estimated $100m was drained.

Huobi Global is set to be acquired by a Hong Kong-based investment firm, About Capital Management.

US CPI is due to be released tomorrow, estimated at 8.1%.

The BoE brought back its QE operations after significant instability across the UK’s financial markets.

Traditional markets, the S&P 500 & the Nasdaq 100, are down 2.69% & 4.36%, respectively, over the past fortnight.

Greythorn views that Bitcoin will range below $21,000 over the upcoming week.

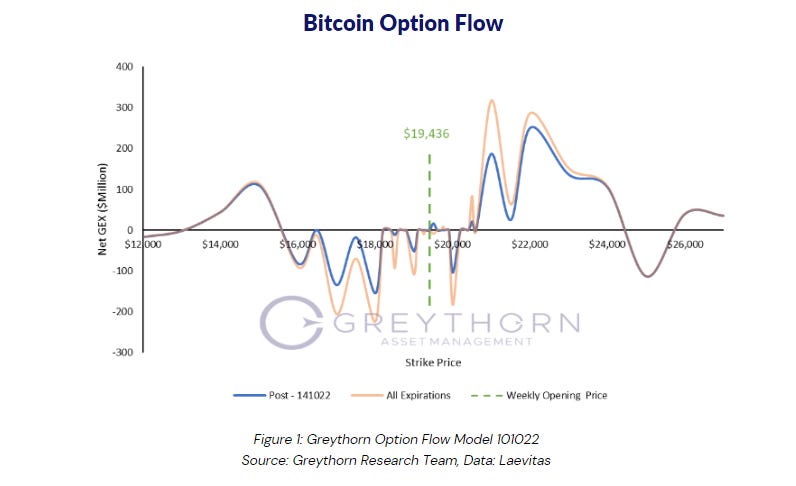

Greythorn Option Flow Model

The market opened at $19,436 this week. Although displaying slight weakness over the weekend, Bitcoin continues to hold its position above $19,000, where it has fluctuated around for the past several weeks.

Increased volatility is expected at a series of price levels with negative gamma supply, namely the interval between $16,000 and $19,000, $20,000 and $25,000.

Should price decrease, $15,000 and $14,000 are the only two significant levels of support. On the upside, the first relatively weak resistance is $20,500. $21,000 is the second resistance level, while the interval between $22,000 and $24,000 and $26,000 are all areas of significant resistance.

Option supply has increased over the past week, indicating relative stability over the next few trading days. Participants are injecting liquidity into the market through option selling, particularly the $21,000 and $23,000 calls.

Considering UK GDP is set to be published on Wednesday, coupled with inflation data from the US & Germany the day after, sharp and extended moves can present themselves with these catalysts.

Greythorn believes that Bitcoin will range below $21,000 over the upcoming week based on our option flow model.

For an introduction to Greythorn Option Flow Model, please refer to our newsletter from 8th June 2022.

Core Research: Cosmos & Chainlink

1. Cosmos Hub

$ATOM is the Cosmos Hub’s primary token and secures the Hub’s interchain services through staking. In turn, stakers receive rewards & vote on governance.

New updates from the $ATOM 2.0 Whitepaper

Instead of serving as a template for building blockchains into the Cosmos “interchain”, the role of Hub has been revamped as the heart of Interchain Security. Other chains can use the Hub to secure their networks, and validators will be rewarded with its revenue.

Changes in the utility and issuance schedule of $ATOM:

The purpose of $ATOM changes from providing security for the Cosmos Hub to value accrual by putting $ATOM at the core to secure a wider swath of the ecosystem via interchain security and liquid staking.

A two-step new monetary policy for $ATOM will eventually bring down $ATOM’s inflation rate to 0.1% over the medium term.

Token: $ATOM

Comparables

Bullish Fundamentals:

Cosmos has a well-developed infrastructure and provides a development framework, Cosmos SDK, which allows developers to develop a customised chain in 15 minutes. 262 applications & services are built on the Cosmos ecosystem.

Cosmos is relatively independent. It can autonomously decide the functions & governance model of the chain. It also has significant cross-chain freedom as opposed to slot auctions like Polkadot.

The Inter-Blockchain Communication (IBC) protocol was launched in April 2021, allowing applications to communicate with each other.

$ATOM will be gradually empowered with more functions, i.e. for use as gas fees, staking and voting.

Interchain Security allows smaller chains to ‘rent security’ from the Hub. This function is set to be available from January 2023. Cosmos contributors have proposed spending 150,000 ATOM tokens (~$1.1m) from the official Cosmos Hub community pool to attract projects that use interchain security.

Bearish Fundamentals:

$ATOM is currently an inflationary token with an annual diluted inflation rate of 12.86% and an estimated reward rate of 17.97%. The real yield amounts to only ~5%, slightly higher than US treasuries.

Since zones are using their tokens for verifications and gas fees, $ATOM currently has a weak ability to capture value despite the increased activity in these zones. Alternatives such as Osmosis (Liquid Centre), Evmos (EVM Centre), Juno (WASM Centre) and Axelar Network (non-IBC) are displaying notable growth.

Few projects launch their mainnet without any native stablecoin support. Cosmos is one of them.

2. Chainlink

Chainlink is a decentralised network of oracles designed to securely and reliably connect blockchain smart contracts and off-chain computation. Being compatible with a wide range of blockchains on the EVM & Solana, users can filter oracles and customise the terms of service with a high degree of flexibility.

$LINK is the native token of Chainlink:

Users purchase services from nodes with $LINK.

Node operators will use $LINK as margin to assure the quality of their services. (Staking & future fee opportunities are utilised to correct nodes’ behaviour)

Nodes with higher margin are more likely to be selected to provide services and earn $LINK.

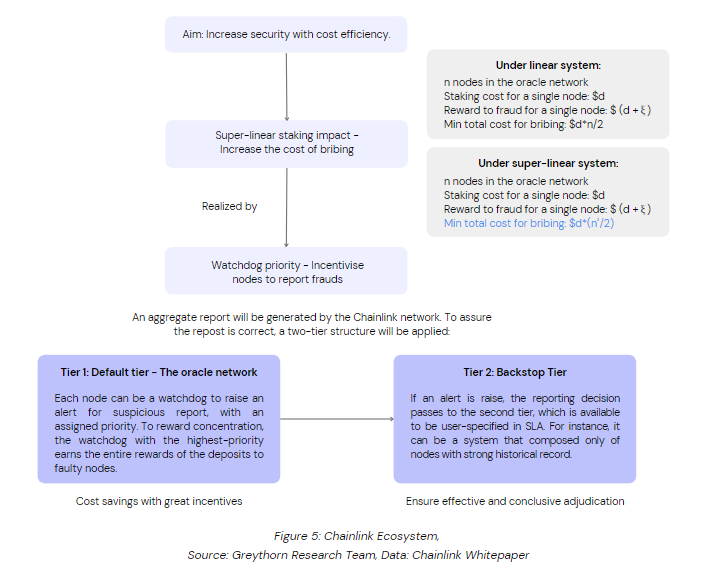

The margin of problematic nodes may be collected by Chainlink as a punishment for providing poor-quality service. The super-linear staking & watchdog mechanisms considerably increase the cost of any potential bribing schemes.

* Implicit-Incentive Framework (IIF) can be seen as parameterisation of the staking system, which reflects node incentives with greater accuracy.

To read the whole article, including analyses on Chainlink and its comparables, please click here to view the whole PDF