Greythorn Fortnightly Newsletter - Issue #7

In-depth insights for the fortnight by the Greythorn Investments Team. Learn more about financial market analytics, option flow, and cash flow generation across DeFi (part 2 on Real Yield).

Crypto Market Insights

Market Summary

Bitcoin & Ethereum are down ~17% & ~21%, respectively, over the past fortnight.

Jackson Hole: Powell's speech on higher rates bringing pain to households & businesses caused a global sell-off across risk assets, with $BTC & $ETH closing down ~6% & ~11%, respectively, on the day.

FTX is set to list $GMX Spot.

Coinbase launches Coinbase Wrapped Staked ETH (cbETH) ahead of the Merge, coupled with the addition of Nano Ether Futures to its derivatives platform.

Traditional markets, the S&P 500 & Nasdaq 100, are down 5.60% & 7.72%, respectively, over the past fortnight.

Greythorn views that Bitcoin will remain between $18,000 and $24,000 over the upcoming week.

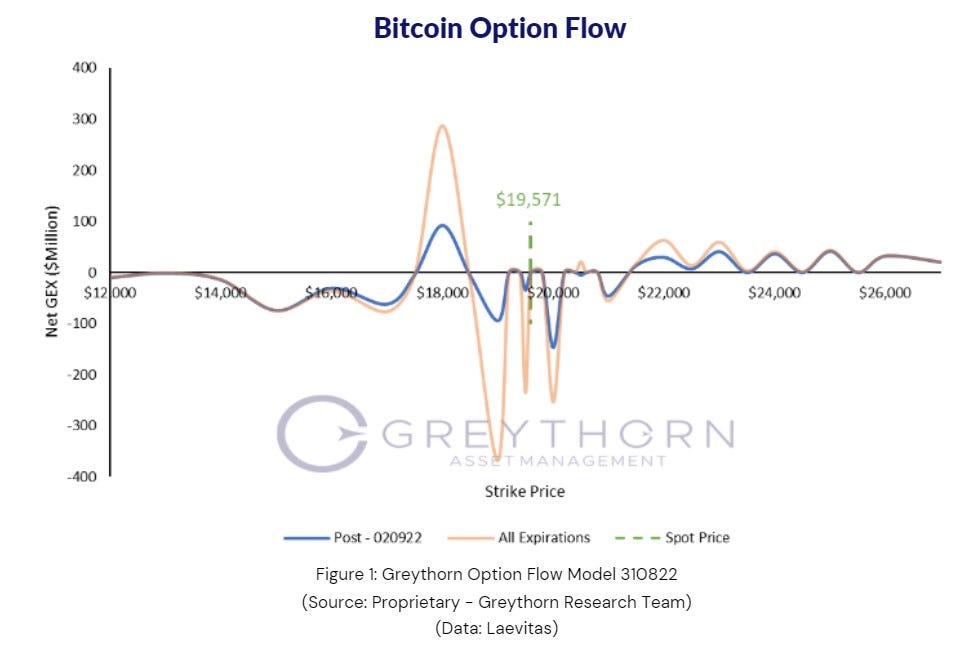

Greythorn Option Flow Model

After the risk-off developments over the past weekend due to Fed Chair Jerome Powell's comments about future monetary policy, Bitcoin opened at $19,571 on Monday.

Option supply decreased dramatically following last week's monthly OpEx, indicating more illiquidity over the coming weeks.

Stagflationary developments will begin to gain the spotlight as policymakers recently approved further fiscal stimulus in the form of student debt forgiveness, coupled with Powell's comments about the pain businesses must endure to bring down inflation.

Labour market indicators, such as the U.S. CB Consumer Confidence (Aug) and Initial Jobless Claims, are set to be released on Aug. 31st & Sep. 1st, respectively.

Increased volatility can be expected at a series of price levels with negative gamma supply, namely the interval between $14,000 to $17,000 and $19,000 to $20,000.

If prices continue to decline, $18,000 is the only significant support level in the short term. Should markets rally, $20,500 can be regarded as a weak resistance level, which will weaken after this week's expiration on Sep. 2nd, with $22,000, $23,000, $24,000, $25,000, and $26,000 as further levels of liquidity.

Greythorn believes that Bitcoin will range between $18,000 and $24,000 over the upcoming week based on our option flow model.

For an introduction to Greythorn Option Flow Model, please refer to our newsletter from 8th June 2022.

Core Research: Real Yield Part 2

Last fortnight, we covered $dYdX, $GMX, & $GNS, dApps that allow for self-custody, decentralised trading & efficient uptime. There is a reason that these projects are trending, and it is because innovation across derivatives markets is at the forefront of user needs. Options trading has gained popularity in both traditional & web3 markets, and the crypto market has yet to find a leader/leading group of protocols to provide this service to the customer.

These projects have identified two different needs across the market, unique products with non-linear payoffs & the payout of protocol revenue to token holders.

The maturity of derivatives markets & the growth of the Real Yield trend signifies how far DeFi has progressed from its early days in 2018 to now, where market participants have gone from investing in ideas to products that provide actual cash flows.

The same trend is observed across traditional markets, where value & cash flows from utilities, health care & infrastructure are prioritised as opposed to speculative tech stocks.

For this fortnight, three projects named Dopex, Ribbon Finance & Synthetix have been on our radar because of the above traits.

1.Dopex — $DPX

Dopex is a decentralised options protocol whose value proposition minimises losses for option writers.

The critical mechanism lies in their rebate system, which compensates option writers based on their losses for weekly/monthly epochs. Writers receive a token, rDPX, relative to the value of their loss from the option pool.

Protocol Stats

Bullish Fundamentals:

30% of option losses are rebated to the user through $rDPX. $rDPX does maintain some form of utility through its use cases, i.e. trading synthetics of traditional asset classes through Umami Finance.

Dopex utilises some of its oracles from Deribit, providing relatively competitive option pricing compared to other decentralised option protocols.

A portion of protocol fees, 70%, is paid out to liquidity providers, 15% is paid out to $DPX stakers, and 5% is set aside to burn $rDPX, reducing its supply. These portions can be adjusted through $DPX governance votes.

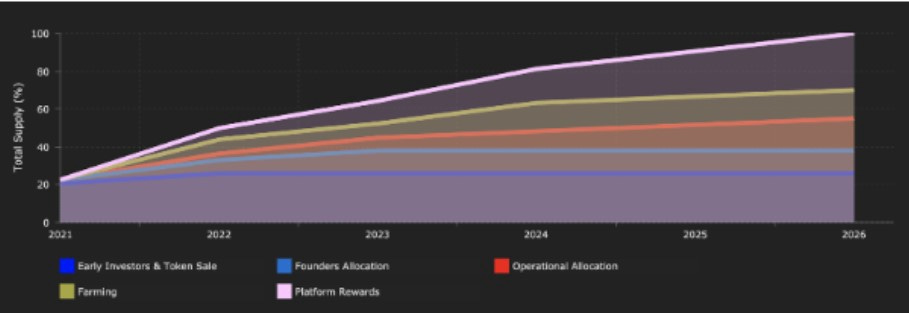

Tokenomics design incentivises protocol improvement over the long-term & minimises significant price impacts from insiders (Founders & Early Investors).

The tokenomics are designed as follows:

Operational Allocation: 17%

Distributed across five years. This allocation is used to initially handle governance, incentivise the development of community suggestions, help develop the platform with new features, and account for other operational costs.

Farming (Liquidity Mining): 15%

The farming period is set to 2 years with an initial boosted rewards period of 4 weeks.

Platform Rewards: 30%

Distributed over a period of approximately five years. These rewards will incentivise the use and upkeep of the Dopex platform.

Founders Allocation: 12%

-20% is initially staked in liquidity pools

-80% vested for two years distributed using a drip system via a smart contract

Early Investors & Token Sale: 26%

-Early Investors: 11%

-50% Vested over six months

-Token Sale: 15%

Bearish Fundamentals:

Single Staking Option Vaults require the position to be fully backed in collateral of the base asset for calls, and USD stablecoins for puts, meaning that option writers do not have access to standard or portfolio margin.

Leading crypto options exchange, Deribit offers slightly more competitive pricing (speed & accuracy) & deeper liquidity.

To read the whole article, including analyses on Ribbon Finance and Synthetix, please click here to view the full PDF.