Greythorn Fortnightly Newsletter Issue #8

Key market summary and analytics for the fortnight by the Greythorn Investments Team. Gain insights into Arbitrum’s transition onto its Nitro upgrade thereby lowering fees and increasing throughput.

Crypto Market Insights

Market Summary

Bitcoin & Ethereum are up ~2.81% & ~9.26%, respectively, over the past fortnight.

The Ethereum network is set to complete its final stage of the Merge tomorrow, the 15th of September. This will mark the beginning of its Proof-of-Stake (PoS) era.

US CPI came in higher than anticipated at 8.3% vs 8.1% est., leading to a -8% close for the Crypto25 Index on the day.

Traditional markets, the S&P 500 & the Nasdaq 100, are down ~2.53% & ~3.64%, respectively, over the past fortnight.

Greythorn views that Bitcoin will remain between $18,000 and $25,000 over the upcoming week.

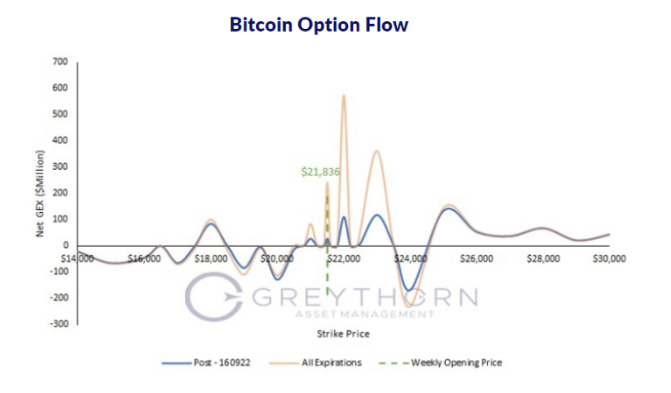

Greythorn Option Flow Model

After increasing sharply over the past weekend, Bitcoin opened at $21,836 on Monday in anticipation of this week’s economic data releases.

Increased volatility is expected at a series of price levels with negative option supply (Net GEX), including $19,000, $20,000 and $24,000.

Should price decrease, $21,000 followed by 18,000 are the only two significant support levels observed. On the upside, $22,000 can be regarded as the first resistance level, followed by $23,000. Price levels beyond $25,000 form a continuous resistance zone.

Option Supply finally rebounded from negative to positive after weeks due to the concentration in the August expiration. This should be prevalent in the improved liquidity of the market over the coming week. This supply has allowed liquidity provision to support the market from its local lows. However, considering US inflation data came in higher than estimates, coupled with the Ethereum Merge scheduled for the 15th, participants should remain wary as to leaning their deltas too heavily on either side.

Greythorn believes that Bitcoin will range between $18,000 and $25,000 over the upcoming week based on our option flow model.

For an introduction to Greythorn Option Flow Model, please refer to our newsletter from 8th June 2022:

Core Research: Nitro Has Arrived

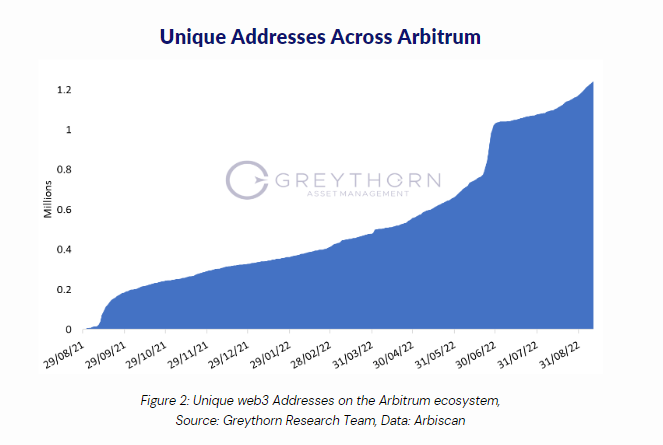

Users continue to flow into the Arbitrum ecosystem as more projects develop & migrate onto the network.

Arbitrum’s popularity comes as no surprise to the markets as the upcoming merge of the Ethereum network has been anticipated since July. For the first time, the ETH token economy is set to move into a new deflationary era with improved throughput & cost of transacting. This fortnight, we will highlight three projects that have benefited from the attention across Arbitrum & offer various products ranging from options, a stablecoin money market fund & yield aggregation.

Jones DAO

Jones DAO is an Arbitrum-native options protocol. The protocol’s key features are two-fold:

Vaults:

The primary vaults seek to generate yield through option strategies focused on covered calls. These vaults cover multiple assets, are actively managed, and optimised. These vaults also allocate 5% towards hedging.

The auxiliary vaults seek to utilise more aggressive & directional options strategies through various spreads.

jAssets: jAssets are yield-bearing tokens that aim to provide capital efficiency & liquidity by utilising locked assets across options strategies. They are minted & burnt upon deposits & withdrawals. Users primarily use their jAssets for:

Lending/Borrowing

Liquidity Pools

The native token of the protocol, $JONES, has several key characteristics:

Liquidity Incentives: Rewards for the lending & liquidity pools

Fee Accrual

Governance

The protocol also uses the Curve model in which $veJONES can be used to vote on emission rates for vaults & pools while accruing a portion of the protocol’s fees & additional $JONES rewards.

The protocol’s revenue is composed of:

2% management fee on total TVL, applied after each epoch.

20% incentive fee on yield generated. *Note that this performance is measured in the underlying asset, not USD.

Bullish Fundamentals:

Capital Efficiency: Unlock liquidity for assets locked in partner protocols, such as Dopex’s SSOV.

$veJONES Optimisation: The utilisation of the Curve model allows inflation to be optimised to vaults & pools that users are using.

Bearish Fundamentals:

Anonymous Signing: Transactions are executed by a multi-sig (multi-signature) wallet, currently approved by five anonymous DAO members who are also protocol strategists.

Delays: The protocol has missed several deadlines concerning improvements such as Metavaults & community strategist vaults.

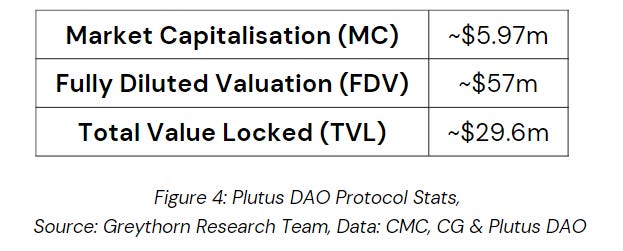

2. Plutus DAO

Plutus DAO is a governance aggregator which enables holders of specific tokens on external protocols to earn additional rewards.

To read the whole article, including analyses on Plutus Vaults & Sperax, please click here to view the whole PDF