Greythorn Fortnightly Newsletter Issue #9

Key market insights and analytics for the fortnight by the Greythorn Research Team. Explore the trending Cosmos L1 and the leading American options protocol on Arbitrum.

Crypto Market Insights

Market Summary

Bitcoin & Ethereum are down 12% & 25%, respectively, over the past fortnight.

The Cosmos 2.0 whitepaper was revealed on Monday, citing interchain security, major new structures for the Cosmos Hub, and a new issuance model for the $ATOM token.

Crypto market maker Wintermute suffered a $160m DeFi exploit last Tuesday. The firm still owes $200m in outstanding DeFi debt to several counterparties but has reassured its community that its OTC business has not been affected.

US interest rates increased 75 basis points at last week’s FOMC conference.

Traditional markets, the S&P 500 & the Nasdaq 100, are down 10.7% & 10.9%, respectively, over the past fortnight.

Greythorn views that Bitcoin will remain below $23,000 over the upcoming week.

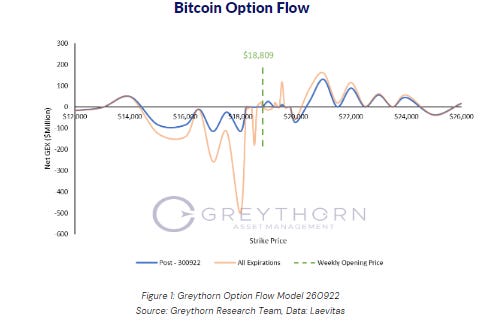

Greythorn Option Flow Model

After the plunge over the past weekend, Bitcoin opened at $18,809.

Increased volatility is expected at a series of price levels with negative option supply, namely the intervals between $15,000 & $18,500, and $20,000 & $25,000.

If price decreases, $18,750 is the next significant support, followed by $14,000 as a relatively weak level of support.

If price increases, the first resistance is $19,500, which is set to weaken after this week’s expiration. $21,000 and $22,000 are the following levels of significant resistance.

Gamma Supply has turned from positive to negative, indicating that the market will remain relatively fragile over the coming week. Downside liquidity remains relatively low, especially given the considerable amount of hedging that can take place at $18,000. US Fed Chair Powell will deliver two speeches on Tuesday and Thursday, while US & UK GDP data is set to be released on Thursday and Friday, respectively. These events, coupled with a notable decrease in OI after this week’s quarterly expiration, pose a catalyst for volatility to catch a bid into the end of the week.

Greythorn believes that Bitcoin will range below $23,000 over the upcoming week based on our option flow model.

For an introduction to Greythorn Option Flow Model, please refer to our newsletter from 8th June 2022. https://greythorn.substack.com/p/greythorn-asset-management-newsletter

Core Research: Kujira & Premia

Kujira

Kujira & Cosmos have garnered plenty of attention over recent weeks, primarily due to the launch of Cosmos 2.0 & Kujira’s value proposition to create a Layer 1 that provides cost efficiency & constructive integration within the broader Cosmos ecosystem.

The platform consists of four blocks: Orca, Fin, Blue & Finder. The first three are DeFi platforms, while Finder is a blockchain scanner.

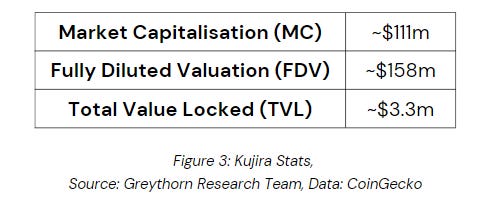

Token: $KUJI & $USK

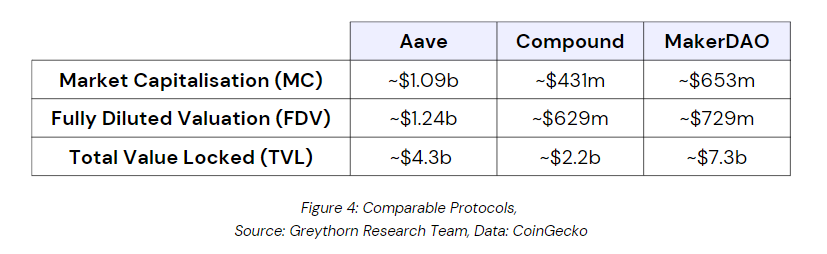

Comparables

Aave: similar to Kujira's lending function

Compound: similar to Kujira's dual-token model

Maker DAO: similar to Kujira's dual-token model

Bullish Fundamentals:

Cross-Chain Security: Kujira will be able to rent security from the Cosmos Hub to improve the safety of its L1 platform. Kujira & Cosmos validators will benefit as Kujira becomes more decentralised & ATOM validators gain more rewards.

Real Yield: $KUJI is non-inflationary.

Ecosystem encourages participation: Orca provides all users with the right to participate in liquidation, while $KUJI stakers are encouraged to vote and actively choose validators aligned with stakers' interests.

Development in the form of:

Black Whale, a platform which offers market marking solutions on Kujira, improves liquidity on FIN & passes on a portion of its fees, 50%, to $KUJI stakers.

Perpetual Swaps are set to be released soon on FIN.

The launch of Kado on Kujira allows fiat holders to easily convert their assets to Kujira & begin trading on FIN.

Bearish Fundamentals:

Strength of $USK Peg during periods of adverse market conditions remains unknown: The collateral to mint $USK is currently $ATOM which has a volatility of 105%. Even though $KUJI will be gradually transferred as the only asset backing $USK, its token model will then become similar to $UST - $LUNA, which displayed weak resilience during periods of market stress.

Directly staking $ATOM provides a return of ~18%, which is relatively competitive to the returns from providing $USK on Orca (3-8%).

Relatively Centralised Tokenomics: Team & Advisors account for more than 28% of token holdings.

2. Premia

While Arbitrum already has options protocols in the form of Dopex & Jones DAO, Premia is the only DEX to offer American options as its core line of products. It offers peer-to-pool trading with options that are fully collateralised.

Its pricing mechanism is ultimately determined by the supply & demand of the pool’s capital leading to various pricing discrepancies between the pool & the oracle. This is advertised as the rate below/above market value & allows for a wide range of opportunities between Premia and other option providers both on CeFi & DeFi.

To read the whole article, including analyses on Premia and its comparables, please click here to view the whole PDF