Greythorn Fortnightly Newsletter Issue #11

Key market analytics and insights for the fortnight by the Greythorn Research Team. Explore the innovative features being developed across bridging and lending markets with deBridge and Timeswap.

Crypto Market Insights

Market Summary

Bitcoin & Ethereum are up 3.39% & 10.4%, respectively, over the past fortnight.

Fidelity is set to provide its clients access to Ethereum trading. The service is expected to launch on October 28th.

US CPI came in at 8.2% for September, above estimates of 8.1%.

Bank of New York Mellon has added cryptocurrencies to its custody services.

Google has partnered with Coinbase to accept crypto payments for Cloud services & also use its custody service, Coinbase Prime.

Traditional markets, the S&P 500 & the Nasdaq 100, are up 5.81% & 5.62%, respectively, over the past fortnight.

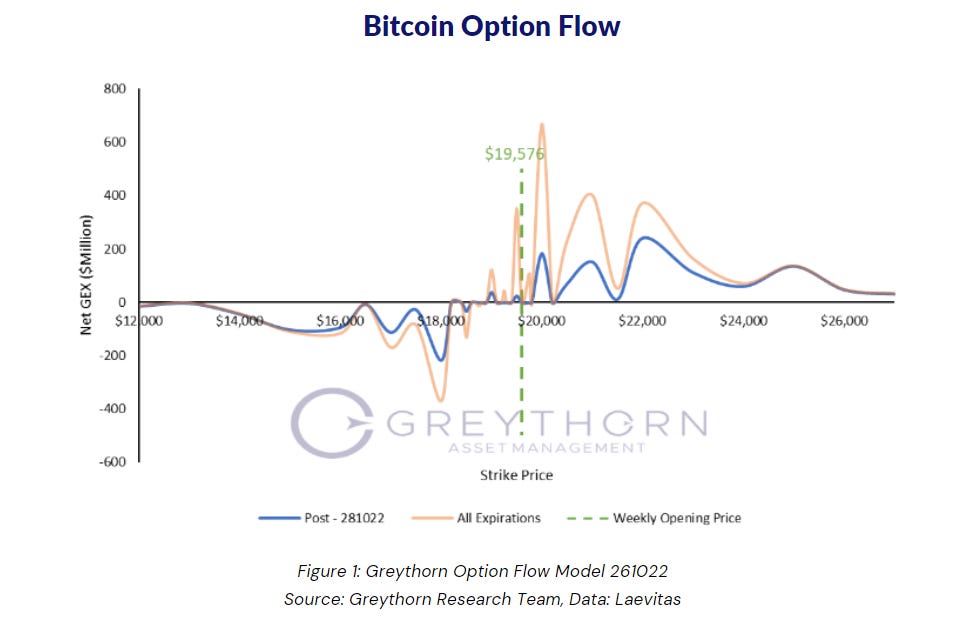

Greythorn views that Bitcoin will range between $19,000 and $21,000 over the upcoming week based on our option flow model.

Greythorn Option Flow Model

Bitcoin rebounded over the past weekend, with both implied & realised vols hovering at multi-year lows. Opening at $19,576, investors will begin preparing for this week’s monthly OpEx, followed by the November 2nd FOMC.

Increased volatility is expected at a series of price levels with negative gamma supply, namely the interval between $12,000 and $18,500, particularly at $18,000.

If price decreases, $19,500 is a significant support, while $19,250 and $19,000 can be seen as relatively weak supports.

To the upside, the first resistance is at $19,750, followed by $20,000 as the most considerable level of resistance for this week. $21,000 is next, and the entire interval between $22,000 and $27,000 can be considered an area of increasing liquidity.

Option supply substantially increased over the past week, indicating more sideways action with less crash risk for the following week. This is observed in the figure above with the magnitude of gamma at current levels, particularly $20,000. Considering US GDP is set to be released tomorrow, followed by EU, Japanese and German inflation data, participants should note that increased volatility may be present around these releases.

Greythorn believes that Bitcoin will range between $19,000 and $21,000 over the upcoming week based on our option flow model.

For an introduction to Greythorn Option Flow Model, please refer to our newsletter from 8th June 2022.

Core Research: deBridge & Timeswap

Exploring the innovative features being developed across bridging & lending markets.

1. deBridge

deBridge is a cross-chain interoperability protocol that enables decentralised transfers of data and value (incl. NFTs using deNFT Bridge) between various blockchains through deSwap API. A network of independent validators are elected by and work for deBridge. The DAO runs nodes to sign transactions and maintain smart contracts. Delegated staking and slashing mechanics act as the backbone for protocol security and provide economic disincentives for validators to collude. Users can build custom bridges to send messages (deSDK) and interact with other blockchain ecosystems (deSwap widget).

Token: None

Comparables

Bullish Fundamentals:

Security: Delegated staking and slashing mechanics ensure the cross-chain bridge operates within a specific service level agreement. If a validator acts dishonestly, the tokens it staked won’t be burned but distributed to delegators as compensation.

Various use cases range from algorithmic stablecoins and synthetic assets (dePort) to gaming and socials.

deSwap Liquidity Network (DLN) will be released soon, which is suited for bridge aggregators looking to offer limitless, zero-slippage cross-chain value transfers with no TVL required. It uses the “liquidity on demand” approach to solve the challenges of the classical “continuously locked liquidity” model. (Twitter & Medium updates posted on Oct.5, still in testing phase)

Bearish Fundamentals:

The current slippage can be relatively high for large transfers of specific trading pairs.

Timeswap

Timeswap is a credit market that utilises the protocol’s supply & demand for pricing as opposed to oracles. The core mechanism lies within its 3-variable AMM that prevents users from being liquidated.

It provides flexibility to the end-user by allowing them to decide on their risk profile and accordingly set the interest rate & collateral for each lending or borrowing transaction. Loans with fixed maturities enable better cash flow planning for projects & organisations.

To read the whole article, including fundamental analysis on Timeswap, please click here to view the whole PDF