Greythorn Fortnightly Newsletter Issue #12

In-depth crypto market analytics and insights for the fortnight developed by the Greythorn research team. Learn about Starkware and the utilisation of ZK-rollups.

Crypto Market Insights

Market Summary

Bitcoin & Ethereum are down 5.69% & 2.79%, respectively, over the past fortnight.

Binance is set to fully acquire FTX after the exchange suffered a bank run following CZ's comments on $FTT.

Arweave partnered with Meta to assist the tech giant in storing data for digital collectibles. Its token, $AR, increased by more than 60% following the news.

JPM executed their first DeFi trade on the 2nd of November. It was based on Polygon using a smart contract from Aave.

The Federal Reserve raised rates by 75 bps at its November meeting.

Traditional markets, the S&P 500 & the Nasdaq 100, are up 1.75% & 2.31%, respectively, over the past fortnight.

Greythorn views that Bitcoin will range between $18,000 and $22,000 over the upcoming week based on our option flow model.

Greythorn Option Flow Model

Following the >4% increase on Friday after last week’s OpEx, Bitcoin fell & repositioned itself at $20,998 over the weekend.

Increased volatility is expected at a series of price levels with negative option supply, namely the interval between $14,000 and $17,000, $18,500 to $20,000, $20,750, $23,000 and $25,000.

Bitcoin is currently hovering around a key level at $21,000.

If price decreases, $20,500 is the first support, followed by $20,000 as the second support after this week’s OpEx. $18,000 can be considered a third support.

Should price increase, $22,000 is the strongest resistance level, while $24,000 can be considered a relatively weak resistance.

Option supply is largely positive, explaining the recent trading range after last week’s brief rally. This supply is observable on the graph by viewing the magnitude of liquidity provision over liquidity-taking, particularly at $22,000.

Traders will be eyeing this week’s midterm elections in the US and CPI release on Friday, accompanied by UK GDP and German CPI data on the same day. It’s important to note that this market always welcomes catalysts like these when getting ready for the next move.

Greythorn believes that Bitcoin will range between $18,000 and $22,000 over the upcoming week based on our option flow model.

For an introduction to Greythorn Option Flow Model, please refer to our newsletter from 8th June 2022. https://greythorn.substack.com/p/greythorn-asset-management-newsletter

Core Research: StarkWare

An exploration into ZK-Rollups & how StarkWare is using them.

Before understanding ZK-Rollups, we need to begin with Layer 2s:

Layer 2s refers to secondary chains built on top of the main, existing blockchain. Their main goal is to solve the scalability problem faced by the main blockchain.

Case Studies:

Bitcoin Lightning Network for Bitcoin.

Optimism for Ethereum.

There are several layer 2 scaling solutions for Ethereum, including ZK-Rollups, Validium, Optimistic Rollups, Sidechains and Plasma Chains.

ZK-Rollups, Validium and Optimistic Rollups are the most popular solutions utilised across the current market. Optimistic Rollups hold a market share of 85.4% across the top ten Layer 2s.

ZK-Rollups and Optimistic Rollups are similar in that they both improve scalability by moving the computation of transactions off-chain & submitting highly compressed data to the mainnet. The differences are:

Optimistic Rollups have greater potential in increasing scalability since they do not require complex cryptographic validity proofs.

Optimistic Rollups have a far lengthier withdrawal horizon than ZK-Rollups due to their challenge period.

Onto StarkWare, Eli Ben-Sasson, the president, mentioned that the token is expected to go on-chain in October.

StarkWare was co-founded by Mr Ben-Sasson, the co-inventor of ZK-SNARK & ZK-STARK (an improved version of ZK-SNARK). It develops STARK-based solutions for the space. Their two main products are:

StarkEx (Scaling as a Service):

Provides customised layer 2 scaling services to dApps(B2B).

Clients include dYdX & ImmutableX.

Exchanges/dApps receive transaction details from their users and send them to StarkEx(Sequencer). StarkEx will convert byte-code from Solidity to Cairo and send them to SHARP (centralised shared prover by StarkWare) to prove validity. Once it is approved, it will be announced on the blockchain.

StarkNet:

A permissionless decentralised ZK-Rollup.

It operates as an L2 network over Ethereum, enabling any dApp to achieve unlimited scale for its computation – without compromising Ethereum's composability and security.

StarkNet contracts & its OS are written in Cairo.

Fees are collected from users for computation, storage, and transaction packaging. They pay the gas fee for uploading transactions to Layer 1. Sequencers can earn more by selecting transactions that pay more fees through an auction.

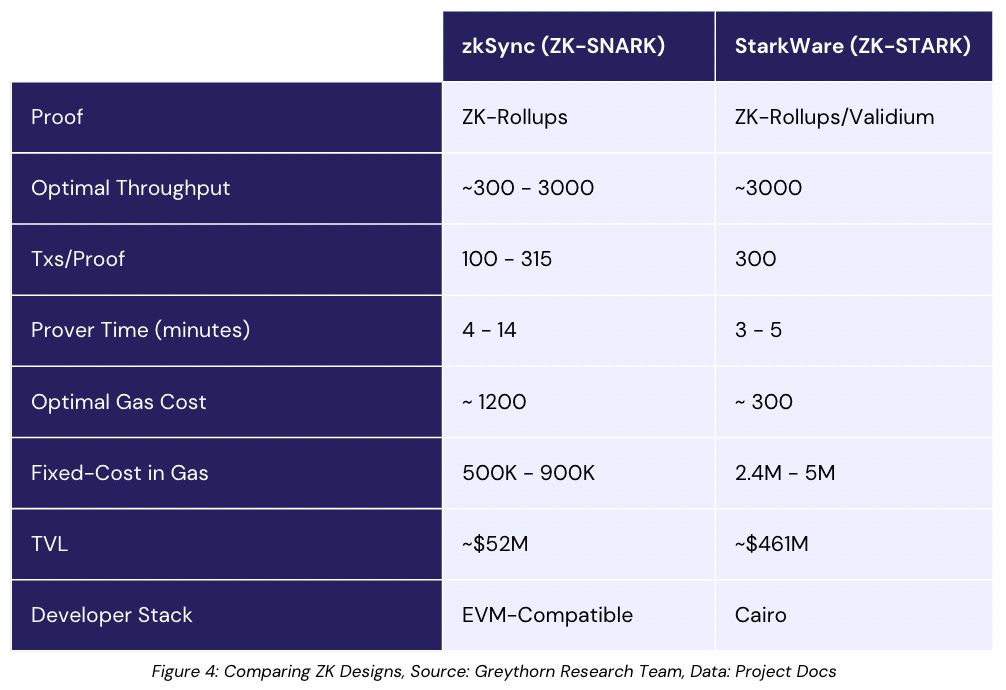

ZK-Snarks vs ZK-Starks

Decentralisation:

ZK-SNARKs require an initial trusted setup phase to generate zero-knowledge proofs. Those parameters are usually held in the custody of a small group. Dishonest actions can occur.

ZK-STARKs do not need the initial trusted setup and, therefore more decentralised & transparent.

Security:

Since ZK-STARKs do not require an initial trusted setup, it uses a collision-resistant approach. It lowers the computation costs of ZK-SNARKs and makes ZK-STARKs unlikely to experience quantum computing attacks.

Scalability:

ZK-SNARKs have a smaller byte size compared to ZK-STARKs. However, their computational demand makes them slower to generate proofs.

ZK-STARK proofs also present a simpler structure in terms of cryptographic assumptions.

Comparable Analytics

To read the whole article, including fundamental analysis on Starkware and its tokenomics, please click here to view the whole PDF