Greythorn Digest #15

A guide into ZkSync's scalability and low costs. Keep up to date with key financial market summary and crypto insights prepared by our Investments Team.

BTC and ETH TL;DR

Bitcoin & Ethereum are up 4.40% and 10.32%, respectively, over the past fortnight.

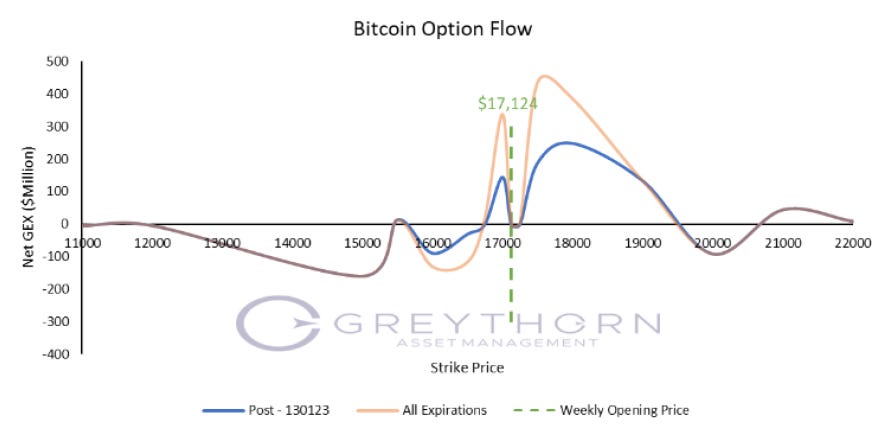

Greythorn views that Bitcoin will range between $17,000 and $18,000 over the upcoming week based on our option flow model.

Bitcoin price has steadily been increasing since the beginning of 2023, partially due to the strong economic reports by the end of 2022 and falling inflation expectations in the US. Opening at a price of $17,124, Bitcoin continues its recent uptrend by trading around $17,200.

Increased volatility is expected at a series of price levels that have negative Net GEX, namely the interval between $11,000 and $15,000, $16,000, $16,500, and $20,000.

If the price decreases, $17,000 is the first significant and strong support level, followed by $15,500 as the next support level. A further drop in value past this last support would accelerate price moves to the downside. Alternatively as indicated in the Net GEX chart, an increase in the price of Bitcoin will be met with resistance zones at the $17,450 and $19,000 levels. Finally, the $21,000 and $22,000 price levels indicated in the previous figure could be deciphered as potential resistance levels should Bitcoin appreciate past $19,000 in the short term.

The value of overall Net GEX remains to be positive, with its value doubling more than it was a fortnight ago. An indicative sign of a more forward-looking stable market for the upcoming week. The graph above can also serve as a visual aid for this demand-supply equation, whereby liquidity provision inflows are larger than its liquidity withdrawal outflows, at $17,000 and $18,000 respectively.

Changing scope into traditional markets, crude oil inventories, CPI data, and Initial Jobless Claims of the US will be released on Thursday and Friday this week along with the UK GDP report that follows. These significant macroeconomic indicators can bring more uncertainties to the Bitcoin market by influencing the market sentiment and increasing market volatility in the interim. Naturally, the precedence of volatility dictates the prime trend which follows, hence a trading strategy based on these limits requires one to also consider the macro and idiosyncratic risks of associated assets invested.

Greythorn believes that Bitcoin will range between $17,000 and $18,000 over the upcoming week based on our option flow model.

For an introduction to Greythorn Option Flow Model, please refer to our newsletter from 8th June 2022. https://greythorn.substack.com/p/greythorn-asset-management-newsletter

A summary of the most relevant market insights for the fortnight to keep investors in the loop.

Highlights of the recent US economic reports

The ISM Non-Manufacturing Index for December fell sharply from 49.6 to 56.5 previously. It was the first time the index dipped below 50 since May 2020, which indicates economic contraction.

Although the payrolls rose by 223,000 versus forecasts for 200,000, it was the lowest number of jobs added since April 2021. The unemployment rate fell to 3.5%, lower than the anticipated 3.7%, while the YoY wage growth was 4.6%, softer than forecasts for 5.0%.

The Fed lifted its benchmark Fed Funds rate by just 50 bps as opposed to the previous 75 bps move (4.25% -4.5%) to relieve the influence of aggressive rate hikes through most of 2022. The unemployment rate fell to 3.5%, lower than the anticipated 3.7%.

DeGods & Y00ts‘s migration

Solana’s top NFT projects, DeGods, and Y00ts are to migrate chains. DeGods will go to Ethereum, while its sister project, Y00ts, will move to Polygon with support from the layer 2's partnership fund. Polygon paid both of the projects $3 million in total in the form of a non-equity grant.

3Comma API leakage

An anonymous Twitter user leaked 100,000 3Commas API keys on Dec. 29th connected to the crypto trading service, after 3Commas repeatedly told users that they had been “phished” after widespread hacks. The FBI has started the investigation.

Crypto tax break for foreigners in the UK

The UK enforces crypto tax breaks for foreigners using local brokers starting in 2023. The measures now in effect are part of the government's plans to turn the country into a crypto hub.

ZkSync: Scalability & Low costs

Basic information:

Token name: TBA (potentially $ZKS).

zkSync is a ZK rollup, a trustless protocol that uses cryptographic validity proofs to provide scalable and low-cost transactions on Ethereum. In zkSync, computation is performed off-chain and most data is stored off-chain as well. As all transactions are proven on the Ethereum mainchain, users enjoy the same security level as in Ethereum.

zkSync 2.0 is made to look and feel like Ethereum, but with lower fees. Just like on Ethereum, smart contracts are written in Solidity/Vyper and can be called using the same clients as the other EVM-compatible chains.

You don't need to register a separate private key before usage; zkSync supports existing Ethereum wallets out of the box.

Team, VCs & Partners

zkSync is supported by Matter Lab from behind, which was founded by Alex G. and Alexander V. in 2018. Matter Lab received a grant from Ethereum Foundation in March 2019 and is committed to using existing technology, zkRollup, to promote the public acceptance of the blockchain.

In March 2021, Matter Lab completed a $6 million Series A round led by Union Square Ventures, while Placeholder and Dragonfly were also involved. This financing round introduced several partners as well, including Aave, Balancer, 1inch, Curve, Binance, Coinbase, Huobi, etc.

To read the whole article on ZkSync, please click here to view the whole PDF