Greythorn Digest #14

Stay informed on the latest crypto news, research analysis and opinion pieces about the financial market. See BTC price analytics and deepen your understanding of zk-rollup with zkLend.

BTC and ETH TL;DR

Bitcoin & Ethereum are up 4.86% & 11.21%, respectively, over the past fortnight. Greythorn views that Bitcoin will range between $16,000 and $19,000 over the upcoming week based on our option flow model.

Greythorn Option Flow Model

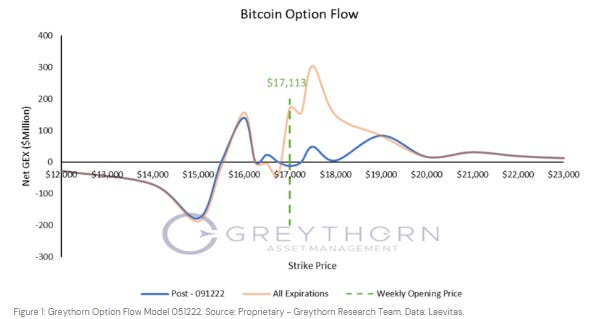

Following the sideway movements in the second half of the last week, Bitcoin opened higher at $17,113 compared with that of the past fortnight due to Powell’s comments regarding the potential slowdown of rate hikes.

Increased volatility is expected at a series of price levels with negative option supply, namely the interval between $12,000 and $15,500, as well as $16,250 to $16,750.

If price decreases, $17,000 is the first strong support, followed by $16,000 as the second.

If price increases, it will move further into the resistance zone between $17,250 and $23,000. In other words, it will take time for the price to significantly increase within this zone of liquidity provision.

Gamma Supply turned negative to positive, indicating a flatter market expected over the upcoming week. This is pronounced by the magnitude of liquidity provision at $17,250 and $18,000.

Taking note of several fundamental economic indicators such as US Crude Oil Inventories and Initial Jobless Claims set to be released on Thursday & Friday, along with Japanese GDP, a potential move away from $17,000 remains possible. ECB President Lagarde will deliver three speeches, which may hint at further policy guidance for the Eurozone going into the new year.

Greythorn believes that Bitcoin will range between $16,000 and $19,000 over the upcoming week based on our option flow model.

For an introduction to Greythorn Option Flow Model, please refer to our newsletter from 8th June 2022.

A summary of the most relevant market insights for the fortnight to keep investors in the loop.

The recovery fund for crypto

Aptos Labs and Jump Crypto are among the prominent crypto companies committed to contributing $50 million to a Binance-led $1 billion Industry Recovery Initiative (IRI). The fund will be used to buy distressed crypto assets following a downturn that has ravaged the industry for the past 12 months. Binance said it plans to increase the fund to $2 billion as it expects participation to increase.

Following up on the Mango Markets exploit

Mango exploiter’s funds got liquidated after roiling Aave using $20m of borrowed curve tokens. A trader identified as Avraham Eisenberg, who became infamous for his “very profitable trading strategy” of exploiting $114 million from Mango Markets, borrowed tens of millions of Curve DAO tokens and sent them to exchange – but his position appears to have gotten liquidated.

Genesis Global Capital and Moelis & Co.

Genesis Global Capital confirmed that it had hired investment bank Moelis & Co. to explore how to shore up its crypto-lending business' liquidity and address clients' needs. The crypto lender also started talks with its largest creditors and borrowers, including Gemini and parent company DCG, to agree on a solution.

Bybit's support funds

Crypto exchange Bybit announced a $100m fund to support institutional clients. The exchange will offer as much as $10 million to institutional clients and market makers.

Japan's digital yen

The Bank of Japan (BoJ) has planned experiments on a digital yen with three megabanks and regional banks in the country. The central bank will decide on issuing a digital yen in 2026.

Research: About zkLend

zkLend is a money-market protocol built on StarkNet, combining ZK-rollup scalability, superior transaction speed, and cost savings with Ethereum’s security.

At its core, zkLend offers a dual suite of permissioned compliance-focused solutions for institutional clients (“Apollo”) and a permissionless service for DeFi users (“Artemis”).

Token Name: $ZEND (TBA)

Accrues protocol fees

Provides incentives for active participants

A portion of borrowing fees are directed to reward borrowing/lending, LPs, community events & marketing/airdrop campaigns.

~20% of the protocol’s operating profit goes toward the treasury to be used for specific asset markets,

5% is for the safe module as a risk management tool to avoid any liquidity shortfalls (up to 30% of stZEND).

$stZEND

Staking: Receive $stZEND at a 1:1 ratio with a 10-day cooldown period for converting back

Current Features:

Revenue Sharing

Emission Rewards

Governance Rights for both protocols on zkLend’s features

Future Features: Membership Perks (discounts on borrowing/lending on Artemis)

Tokenomics

Total Supply: 100,000,000 $ZEND

Current Investors

Delphi Digital (Lead)

StarkWare

GBV

CMS

MetaCartel Venture

Amber

To read the whole article, including bullish and bearish fundamentals on zkLend, please click here to view the whole PDF