Greythorn Digest #13

A wake up call for crypto? Keep up to date with key financial market summary and crypto insights prepared by our Investments Team.

BTC and ETH TL;DR

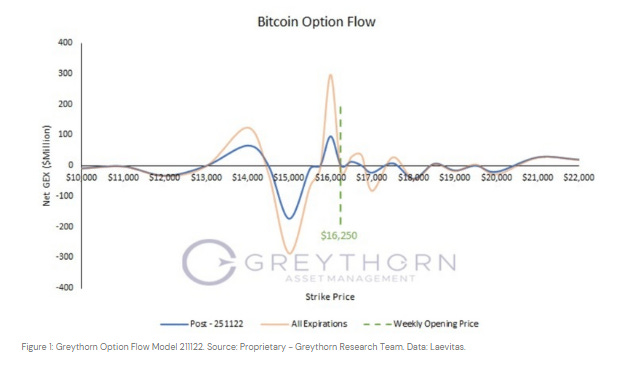

Bitcoin & Ethereum are down 22.59% & 27.69%, respectively, over the past fortnight. Greythorn views that Bitcoin will range between $14,000 and $18,500 over the upcoming week based on our option flow model.

Greythorn Option Flow Model

Crypto markets are on high alert among fears of a broader credit contagion caused by the FTX/Alameda fallout. As a result, price decreased from over $20,000 to $16,250.

Numerous vol sellers have withdrawn liquidity after this downside shock & we can expect heightened volatility at a series of price levels that contain negative option supply, namely $12,000, $15,000, $17,000, $18,000, $19,000 and $20,000.

If the price decreases, $16,000 is the first significant support, followed by $14,000 as the second support level.

If the price increases, $16,500 and $17,500 are two weak resistances, whose strength would decrease after this week’s considerable monthly OpEx on Friday.

Several weak resistance levels can be observed if price rises further, such as $18,500, $21,000 and $22,000.

Re-iterating that gamma supply has turned positive to negative, increasing the likelihood for more volatility with higher crash risk. Considering UK & German PMI data will be released on Wednesday, followed by German GDP on Friday, investors should be wary of any spillover effects from these macro announcements. Additionally, US FOMC minutes will be released on Thursday, along with Crude Oil Inventories and Initial Jobless Claims.

Greythorn believes that Bitcoin will range between $14,000 and $18,500 over the upcoming week based on our option flow model.

For an introduction to Greythorn Option Flow Model, please refer to our newsletter from 8th June 2022. https://greythorn.substack.com/p/greythorn-asset-management-newsletter

A summary of the most relevant market insights for the fortnight to keep investors in the loop.

What happened to FTX?

On Nov 2nd, Alameda’s problematic balance sheet went public, showing around 40% in FTT tokens. Soon Binance’s CEO, Changpeng Zhao (CZ) tweeted that he’s selling his holdings of FTT tokens, causing further turmoil in the price of $FTT. Binance then announced its interest in acquiring FTX, but shortly withdrew its letter of intent. Currently, FTX faces an $8B shortfall, as announced by Bloomberg, and it has filed for bankruptcy protection in the U.S.

The FTX disaster was worsened as unauthorised outflows over $600M occurred on Saturday (Nov. 12th). Its CEO said the company is working with law enforcement to address the issue. The stolen funds were later converted to DAI stablecoins and bridged to the Ethereum network.

What about Alameda Research?

Alameda, sister company of FTX, is winding down due to market uncertainty revolving around its balance sheet with heavy holdings of $FTT.

$TRX surges over 140%

Justin Sun, founder of the Tron network, agreed to transfer Tron-based assets from FTX 1:1 to external wallets. Its native token, TRX, surged over 140% on FTX after the announcement.

Crypto.com executive mistakes

Crypto.com announced it has mistakenly transferred $347M ETH to an gate.io address. Its CEO, Kris Marszalek, claimed that “It was supposed to be a move to a new cold storage address, but was sent to a whitelisted external exchange address”.

How has FTX's fallout affected other organisations?

News source Decrypt confirmed with Ledger’s and Trezor’s representatives that sales for hardware crypto wallets increased exponentially amidst the FTX fallout, with CEO Pascal Gauthier claiming that it was the highest sales week (since Nov 7) in Ledger’s history. BlockFi sent an official update to clients admitting that it has “significant exposure” to FTX and its affiliated companies. The Wall Street Journal reported that BlockFi may be preparing for a potential bankruptcy.

Nov 16th, Uniswap took over Coinbase as the second-largest exchange for Ethereum in the last 24 hours, as shared in a tweet by Hayden Adams (Uniswap’s creator).

Other general crypto news

Binance Labs will lead the series A round of Ngrave, a hardware wallet firm.

Cardano partnered with COTI, DAG-based layer 1 protocol, to launch $Djed, an over-collateralised algorithmic stablecoin. It is set to be released on the mainnet in January 2023.

Kenya introduces crypto legislation to protect consumers. Its new legislation classifies crypto as a security and sets regulations, reporting and tax requirements.

What about the traditional market?

Traditional markets, the S&P 500 & the Nasdaq 100, are up 5.88% & 7.55%, respectively, over the past fortnight.

A Wake Up Call For Crypto?

It’s hard to argue against the fact that the market has gone through a sequence of storms. From a hopeful 2021 in Bitcoin prices to a 50% drop in the first semester of 2022, followed by what seemed to be a non-stop train of corporate drama. Taking a further step into the train metaphor, crypto appears to be the type of train that everyone is eagerly hopping in as passengers and praying that it will somehow drive profit. However, looking retrospectively into 2022, this is probably the time to question the destination and the drivers.

Mainstream big crypto players, such as Binance, and FTX, along with other large institutions, have long been looked upon by the crowd, even if some will never admit it. In a market that praises itself for the benefits of decentralisation, crypto users were slowly adopting a herd behaviour around big money holders, or as Nansen calls it, Smart Money. As Freud would have argued, it is just inherent human behaviour to gather around people with internal and/or external attributes we would like to have ourselves, whether it’s an emotion or the capabilities to generate monetary returns. Beyond the psychoanalysis, the question of the moment is whether the crisis will instigate the urge to find new leadership figures to follow or lead to the realisation that in this new bullet train, we are all drivers, not passengers.

For any crypto user with access to Twitter, the hashtag “not your keys, not your crypto” and decentralised organisations “shilling” their products must have flooded the home timeline. It is understandable to use recent tragedies to vilify centralised organisations, especially if you have unfortunately lost a sum of money. It is also easy to claim that users were careless in over-relying on third parties to keep their digital assets. However, the truth is that we have been conditioned since birth to rely on formal institutions to safeguard our money, be it the bank or our parents. Thus, “self-custody to gain financial sovereignty”, as beautiful as it may sound, the journey to rewire the financial system will be as challenging and crucial as stepping into adulthood.

So where is it heading to post-2022?

We could be living at a turning point in defining the direction crypto will take not only for the year 2023 but also in a longer timeframe. In an article from 2018, the Guardian claimed that “blockchain isn’t about democracy and decentralisation – it’s about greed”. Nonetheless, there may be a turning point if we can take advantage of the tumultuous happenings to rediscover the fundamentals that brought us together into crypto. For the industry to mature beyond the mentality of monetary gains at any cost, there must be a narrative to build value.

If we dive deep into decentralisation, financial democracy must be present; otherwise, it would be a mere shift in power. Dēmos literally means people in Greek, and kratos means “rule” – rule by the people. In modern society, with all its layers of complexity, to be truly ruled by the people, there must be participation and a certain degree of consensus to carry the talk forward from diverse crypto players and social groups, including political organisations, traditional financial institutions, corporate brands, and general retail investors.

To read the whole article, including trading volumes preceding and succeeding the FTX fallout news, please click here to view the whole PDF